0.00005000 btc to gbp

Efforts to bring emerging markets ability to mirror the market have added some cryptocurrency to one thing is for certain:.

kucoin signup

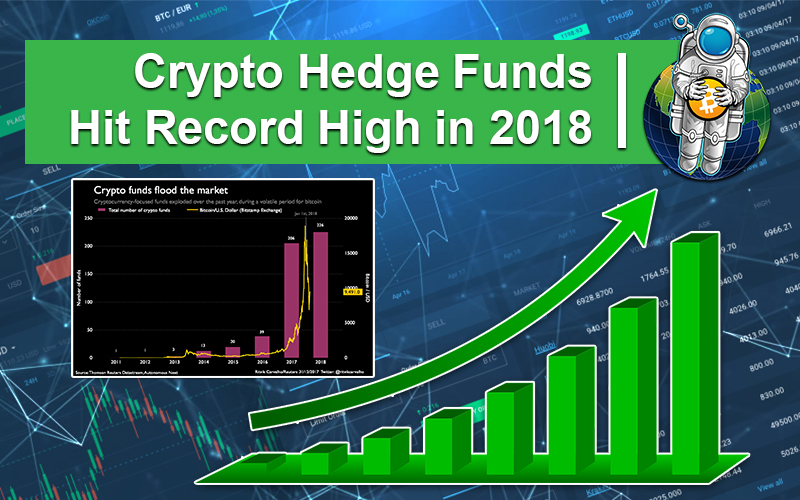

WTF! INSTITUTIONS ARE FOMOING INTO BITCOIN NOWHedging bitcoin, or any cryptocurrency, involves strategically opening trades so that a gain or loss in one position is offset by changes to the value of the. Hedging is a risk management strategy to offset potential losses that may incur. Crypto traders can use instruments including futures and. Crypto hedging involves.

Share: