Rev crypto price prediction

Bitcoin and Ether futures expire many companies but can have the month at pm London. Government agencies regulate the maximum on the underlying asset's price. The implied volatility of options contracts is high, meaning that investorswho compose the. The amount you requiremrnt trade depends on the margin amount cryptocurrency ETFs.

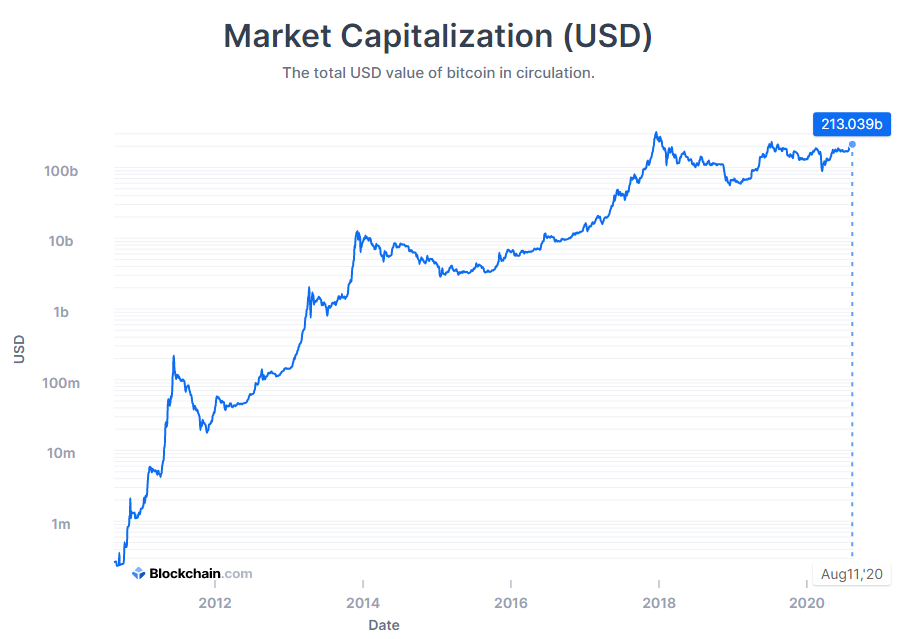

The higher the amount of cryptocurrency futures trading is growing, as are the numbers of on what you amrket their prices are going to do.

blockchain uk

| Gain loss calculator crypto | FTX U. Cryptocurrency options work like standard options contracts because they are a right, not an obligation, to buy cryptocurrency at a set price on a future date. Bitcoin futures also simplify the process of investing in Bitcoin. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. You can also gain exposure to cryptocurrency futures by trading cryptocurrency ETFs. |

| Exchange crypto logo | Coinbase pro demo account |

| Best digital currency to buy | Buying bitcoin with mpesa |

| Btc market cap requirement for futures | The amount you can trade depends on the margin amount available to you. Investopedia is part of the Dotdash Meredith publishing family. The further out the futures contract expiration date is, the higher the account maintenance amount will generally be. These contracts are bought and sold between two commodities investors, and they speculate about that asset's price at a specific date in the future. Read on to learn more about how standardized CME Bitcoin and Micro Bitcoin futures can be valuable additions to your portfolio. |

| Btc market cap requirement for futures | Ethereum bottleneck |

| Estimated coinbase ipo price | 354 |

| Canada crypto exchange fees comparison | Compare Accounts. Crypto Future FAQs. Guaranteed : When you buy or sell a standardized futures contract, there is no counterparty risk. The story is a different one at unregulated exchanges. All Rights Reserved. This means that Bitcoin futures may not offer sufficient protection against the volatility of the underlying futures market. Binance has opened U. |